Навчальний посібник для студентів економічних спеціальностей

UNIT 1 BUSINESS COMMUNICATION

1.1 COMMUNICATING IN BUSINESS

1. Communication is the process by which information is exchanged in a number of ways:

- through the written word; - through the spoken word;

- through pictures and diagrams;

- through facial expressions, behaviour and posture; - through non-verbal sounds.

2. The functions of business communication. We communicate in business for a number of different reasons, and the methods we use will depend on the reasons, the circumstances, and perhaps the people with whom we are communicating. These are some of the reasons why we may need to communicate with others in a business setting:

-  to pass on information

to pass on information

- to persuade people to buy a product or use a service

- to discuss an issue

- to recommend a course of action

- to make or answer a request

- to make or answer a complaint

- to keep a record of something that has happened or been agreed - to explain or clarify a situation - to give an instruction.

3. Clearly, to cover such a variety of situations, you will need to be able to use a range of different methods and styles. Your style and

tone are unlikely to be the same if you are making a request, for example, as if you are making a complaint. You are also more likely to speak to an interlocutor than to write to them if you want to discuss an issue, whereas a record of something that has happened would need to be in writing.

4. Whether you communicate in writing or orally will depend on the circumstances, and to some extent on the person or people you are addressing.

5. The main reasons for communicating orally are:

- To have a discussion. It is very difficult to hold a meaningful discussion by letter, memo or e-mail.

- To receive instant feedback from your audience. Speaking to someone means that you do not have to wait for their response. However, this can sometimes be a disadvantage; in some circumstances, a considered response might be better.

- To be able to judge your audience’s reaction to what you are saying. This usually only applies in face-to-face communication, but it can sometimes be useful to be able to judge from your audience’s comments, expressions or body language what they think of what you are saying and perhaps adapt your style or tone accordingly.

- For speed. Even the fastest typist or writer cannot match the speed at which we speak, so if you want to communicate something quickly, it might be better to do so orally.

- If the person with whom you are communicating has initiated the conversation. If you are responding to an oral request, for example, you are likely to do so orally, unless your response is so complex that it would be better explained in writing.

6. The main reasons for communicating in writing are:

- To retain a permanent record. A conversation can be forgotten, misunderstood or even deliberately twisted. But if something is in writing (and if it is well written), everyone who reads it will be sure to get the right information. It also provides something to refer to if there is any dispute in the future. This is particularly important if the document constitutes a form of agreement, but it can also be useful in the case of a complaint.

- To provide a basis for discussion. We saw above that a discussion is usually best conducted orally, but it can be very useful for a discussion document to be available beforehand, setting out the facts of the case and perhaps giving the writer’s own views and recommendations. This saves time, as it means that the meeting itself can discuss the implications and people’s opinions, instead of having to go over the facts before any useful discussion can begin.

- To clarify a complex subject. Some subjects do not lend themselves easily to spoken communication. A graph or bar chart, for example, may be a better way of presenting figures, and it is easier to explain a confused situation in writing than orally.

- To send the same message to a number of people. If you want to give a number of people the same information (perhaps the date and venue of a meeting), then an e-mail or a circular memo or letter would be quicker and cheaper than speaking to each person individually.

- To be able to think carefully about what you want to say. You can plan your document and correct any errors before sending it out. It is easier to make a mistake when you are speaking spontaneously.

|

communication facial expression posture business setting pass on course of action request complaint keep a record a range interlocutor discuss an issue whereas record meaningful instant feedback response considered body language typist match the speed conversation retain deliberately twisted |

комунікація, спілкування міміка, вираз обличчя положення тіла ділова обстановка передавати спосіб дій запрос, заява скарга, претензія записувати велика кількість співбесідник обговорити спірне питання в той час як запис, письмова фіксація змістовний миттєвий відгук дія у відповідь виважений мова тіла друкарка встигати за темпом розмова, бесіда фіксувати, зберігати навмисно змінений |

constitute available beforehand implications

go over the facts

lend themselves easily bar chart confused message

circular memo

spontaneously

1. Answer the following questions. утворювати завчасно представлений в розпорядження висновки повторювати обставини справи та

аргументи сторін легко здаватися план-графік плутаний повідомлення інформаційне письмо до цілого ряду

адресатів експромтом

1. What are possible objectives of business communication? 2. What are the main reasons for communicating in writing? 3. What means of communication do you know? 4. When is it preferable to communicate orally? 5. Why is it necessary to use different methods and styles of communication in business sphere?

2. Agree or disagree with the statements.

1. A face-to-face communication is preferable if it is necessary to retain a permanent record of a conversation.

2. If you don’t want to lose your time, it might be better to communicate through the medium of business letters.

3. When it is necessary to give a number of people the same information then a telephone call to each person individually would be advisable.

4. Whether you communicate orally or in writing will wholly depend on your financial capacity.

3. Supplement further information on the topic “Methods and styles of business communication”.

1.2 WRITING A BUSINESS LETTER IN ENGLISH

The basic business letter has its unified structure containing the following parts:

1. Return address (or sender's/addresser's location) is the name and the address of the company, beginning from the smallest division: the name of the company, house number, street, city, state or province and ZIP code, country. Business letters usually have a printed letterhead. It usually has all of the company's information, including address, phone number, fax number, company Web site and personal e-mail address. It may be written on the right side or at the top of the page.

2. Date - it's the date when the letter was written and signed. It is below the return address. It may be written in American style (month, day, year) or in non-American (day, month, year). But it is better to spell month not to make confuse: 12 January 2006, not 12.01.06.

3. Destination address (or receiver's/addressee's location) – the address and the person to whom you are writing. The information should be given in the same order as the return address. Usually it is written close to the left margin.

4. Reference - here you name the main topic of the letter. For example: Re: Purchase Order 1132 of November 24, 2008.

5. Salutation - when you name the person to whom you address. Example: Dear Dr. Brown or Dear Mr. White. When you don't know whom to address in company, you should use the formula Dear Sir (or Dear Madam, Dear Ms), or To whom it may concern.

6.  Body - the body of a letter tells about the subject of the letter. Usually it has four parts:

Body - the body of a letter tells about the subject of the letter. Usually it has four parts:

(I) opening - where you give the reason of writing or involve the reader in the theme of your topic;

(II) focus - where you provide details and explain what exactly the problem is;

(III) action - where you say what will happen next or what actions you are going to undertake;

(IV) closing - be positive; here you thank the reader or demonstrate your hope for the positive result of your addressing,

something like I look forward to hearing from you soon.

7. Complementary close is the phrase you use after you end the body of the letter and before you sign your name. It may be:

Truly yours.

Cordially yours.

Sincerely yours.

Faithfully yours - only for formal complimentary closes.

Sincerely yours, or Yours sincerely for both - formal and informal style. Cordially and yours truly are appropriate only for informal complimentary closes.

8. Signature and typed name and title of sender - the writer's name and job title (or department) are typed at the bottom of the letter. He or she then signs the letter directly above the typed name.

9. Postscript is a brief sentence or paragraph introduced by the initials, “P.S.” (“post scriptum” Latin for “after having been written”). It implies that the writer, having completed and signed the letter, had an after-thought. Although this is still commonly used in informal letters, it is not widely accepted for use in formal or business letters.

10. Enclosure - you add it in the left bottom corner of the page if you are sending something

with the letter.

business letter діловий лист return address зворотна адреса

ZIP code (zone improvement plan code) поштовий індекс

printed letterhead штамп фірми на бланку листа, фірмовий бланк

top of the page верхня частина сторінки destination address адреса призначення

reference посилання (до попереднього листа) salutation привітання body головна частина opening початок, вступ focus фокусування на темі листа

action лінія поведінки, ймовірний ефект closing заключна частина

complementary close ввічлива прощальна фраза

typed name and title postscript after-thought

enclosure

1. Answer the questions. машинописний варіант імені та посади приписка до листа пізня думка додаток

1. Does a letterhead signify the return address or the destination address? 2. If you put the date in American style what does it mean? 3. What does abbreviation "cc" in letters mean nowadays? 4. What does the word "enclosure" mean if it stands at the end of the message? 5. What is a typical structure of the body of a letter? 6. Where is the destination address usually written?

2. Supplement further information on the topic “Golden rules of communication”.

1.3 CHOOSING JOBS

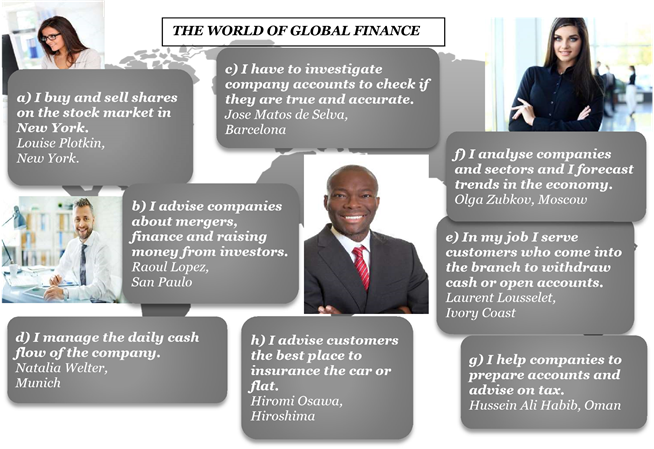

1. Read the profiles of the people talking about their jobs in finance. Match the profiles a-h with the jobs 1-8.

1. an equity trader a_

2. a customer adviser in bank ___

3. an insurance broker ___

4. an accountant ___

5. an investment banker ___

6. an auditor ___

7. a company treasurer ___

8. an analyst ___

2. Work in pairs. Which of the jobs in 1

• appeals to you the most? is the most stressful?

• requires the longest training? is the best paid?

3. What are you looking for in a job? Which four of these features are most important to you?

Rank the features 1-4 (1= most important).

• to work in a local company near my home

• to work in a large international company

• to work long hours, but get a big salary

• to have evenings and weekends free

• to work directly with customers and the public

• to work with statistics and tables

• to work with companies' financial accounts

• to work on the financial markets

• to have a lot of responsibility early in my career

Work in groups of three or four. Explain your choices to your partners and decide together which of the jobs in 1 would suit each of you the best.

Describing a job vocabulary

1. Look at the groups of verbs in 2 that people use to describe their jobs in finance.

Work in pairs. Discuss the differences in their meaning. Look at examples of how they are used and which words they are used with in a dictionary like the Oxford Advanced Learner's Dictionary.

2. Complete the sentences with the best verb.

In my job I have to ...

advise answer serve

1. _____ customers on their choice of financial products

2. _____customers who need cash or to make payments 3. _____ telephone enquiries

analyse forecast set

4. _____ what will happen to consumer demand for the next twelve months

5. _____ the financial results for last year

6. _____ a budget for spending in each department borrow issue lend raise

7. ______shares or bonds

8. ______capital by issuing shares on the financial markets

9. ______money to customers

10. ______money from the banks in short –term loans

Investigate manage prepare

11. _____ the accounts at the end of each quarter

12. _____ the accounts to check for accuracy

13. _____ the cash in our current accounts.

14.

3. Now, using the verbs in the boxes below, complete the two job adverts from an Internet website for financial recruitment.

![]()

An exciting opportunity has arisen at one of the UK's largest banks within a lively call centre environment on the inbound/outbound customer service department.

![]()

As a customer relationship trainee, you will have to __________1, customers who want to carry out transactions, __________ 2 questions, and ___________3 them on the right products to suit their needs. The work involves making quick decisions about customers who want to _________4 money on their credit cards and deciding who to __________5 money to by using our credit check systems. NO COLD CALLING INVOLVED!!!

Supporting our marketing division, you will have to_________ 6 reports on internal errors and

________7 customer complaints plus ________8 a database of customer usage.

Previous call centre/sales experience is preferred, but not essential, as full training is provided. If you are interested in the above role, please call immediately on 0234 326 7635.

![]()

|

advise lend |

answer borrow |

investigate manage |

prepare serve |

advise manage raise set

![]()

International opportunities for young graduate accountants to train in a multinational accountancy team. Working in San Paulo, Brazil, you will be responsible for advising international companies on their operations in the country. Key tasks include presenting solutions to clients on

how to _________9 cash flow more efficiency how to _________10 capital from the banks how to _________11 budgets and implement control systems how to _________12 clients on better tax planning

![]()

IT’S MY JOB

1. Look at the list of qualities that could be important to work in financial markets. Mark them VI (very important), QI (quite important), or NI (not important). Then compare your answers in pairs.

having a lot of experience in business or finance ________□ being able to get on well with your clients ________□ being good at working in a team ________□ being good at socializing ________□ being good at listening to and remembering information ________□ being able to think quickly ________□ being good at taking risks ________□

2. Now read an interview with Jilly Atkins, a bond trader who works in the debt markets, buying and selling government debt. Tick (√) the qualities in 1 that she mentions.

![]()

Jilly Atkins

![]()

|

|

Before you got your job, did you study business or finance at college? No, actually, I didn't. In fact, when I applied for my first job, I really had no experience in finance. I just looked on the Internet to see which finance jobs paid the best. I saw that as a bond trader you could earn £100,000 after only two years in the job. So I decided that was the job for me!

What skills and qualities were they looking for? I hope I impressed them. You definitely need good personal skills in this job because everything depends on contacts. You have to be good on the telephone so people want to call you with a deal. But it's not only in the office. If you want to make a lot of money, you also have to socialize and network with clients at night. That means lots of eating in restaurants. That's where you hear the best news. You're always competing with other banks for the same business so you have to keep the clients very happy. It's fun, but hard work. |

It's a very demanding job. Do you work a long day? Yes, I do. We start work every day at 7.00 a.m. We have to go to the morning briefing, when the analysts tell us about information in the news that is important for prices. Then the head of the division explains the strategy for the day. We begin to call people at 7.40 and the markets open at 8.00 when we make the first deals. The phone never stops and we have to keep a lot of information in our heads.

How much money are you dealing in? We are trading in tens of millions and that means you can't make any mistakes. The profit on a deal is so small that we have to trade in very large quantities to make money. So the ability to think fast and decide things quickly is essential.

I think I know what you will say to this question ... Is your job interesting? Yes, of course, it's absolutely fascinating. |

3. Read the interview again and write T (true) or F (false).

1. Jilly chose her job mainly because of the salary.

2. Nearly all the trading takes place outside the office.

3. Clients normally prefer to deal with just one bank.

4. Traders need to have an excellent memory.

5. Traders often make a big profit on a single deal.

4. Webquest

Go on the Internet to find this information.

1. Who are the best international companies to work for in finance? Look for companies who win international awards for 'best places to work' or companies who come out best in international comparisons. Try www.ft.com as a starting point.

2. Make a list of the best four companies you have found and their best features. Work together and tell the group the results of your research. Decide together what you need to consider when choosing a company to work for.

Reading

WHAT CAN YOU EXPECT FROM A CAREER IN BANKING?

You are going to read two reports from a university magazine on careers in banking. Helen works in the corporate finance department of an investment bank and Angus is a customer service advisor in a retail bank.

1. Discuss these questions in pairs.

• What do you think each job involves?

• What skills do you think each job needs?

![]()

Angus Fraser (2004-07) Customer advisor

![]()

After university, I joined the Glasgow branch of Fleetwood Bank as a trainee customer advisor. It is a client-facing job, meeting customers who come in to the branch and advising them on how to manage their money. That means I need a good knowledge of savings accounts, loans, and mortgages, but we have weekly meetings to learn about these products.

In this work, you must have good relationship skills

because the customer gives you private information and must trust the advice you give. It is also important to be systematic and accurate because you have to enter the information in electronic forms.

On a typical day, I can see about 50 customers in private interviews and it makes a long day. I usually start at 9.00 a.m. (by checking my appointments diary) and finish at 6.00 p.m. So I work about eight hours, but it takes another 45 minutes to get home.

The salary (£20,000 p.a.) is not great, but it is very satisfying to work with people and know that you have helped them to plan their financial decisions well.

![]()

Helen Marshall (2003-06)

Analyst, Morgan Straits

![]()

If you join an investment bank as a graduate trainee, you can expect to work long hours. It's part of the culture.

My day starts at about 8.00 a.m. when I check my email and voicemail to see who wants information immediately. It can continue until about 1.00 in the morning if we are working on a big merger. Fortunately, I live only twenty minutes from the bank. I usually get my main work from my boss at the daily team meeting at 10 o'clock, which can be a comparative analysis of companies or completing a report on a loan application for a big company.

As an analyst, you need to be good at statistics because you spend a lot of the day working at the computer on tables or spreadsheets. It's also important to be well organized and a good team player because you depend on your colleagues to meet deadlines.

It is a very exciting job because you learn very quickly and they are good at giving you training - I have already done courses on how to value companies and on accountancy. But there is not much chance of meeting with customers, so you can feel isolated at times. After a year, I still love the excitement of the job and the salary is great, £40,000. But if you are thinking of joining an investment bank, make sure you are well motivated and good at computer skills before you start.

![]()

2. Work in pairs and complete the questions below.

1. Who ________ work for?

2. When (start) _________ in the morning?

3. What sort of skills __________ need?

4. What tasks ___________ in the office?

5. What kind of reports ___________?

6. How many customers ___________ each day?

7. How much ____________ earn?

8. How often _____________ meetings?

9. How many hours __________ in a day?

10. How long (take) ___________ get home?

3. Student A, read the text about Angus on the previous page. Student B, read the text about Helen.

Find the answers to the reporter's questions in 2.

4. Student A, you are the reporter. Interview Helen and ask her about her job.

Student B, you are Helen. Answer your partner's questions and tell them about your job. Now change roles: Student A, you are Angus. Student B, you are the reporter.

5. Now work together and find the words in the two texts to match the definitions.

Someone who ...

1. has finished university is a _______.

2. is starting in a company is _______.

3. works well with customers has ______.

4. doesn't make mistakes is ______.

5. works well with other colleagues is a ______.

6. is enthusiastic about their job is ______.

1.4 APPLYING FOR A JOB

When you finish high school or university, you will look for a job. The first step will be contacting the company you want to work for. How? With a job application which is a proposal to work for them.

1 The application process involves different steps. How do you think this process works?

Put the steps in the correct order.

![]() The company reads your application, thinks you could be the right person and contacts you for an interview.

The company reads your application, thinks you could be the right person and contacts you for an interview.

You accept and start working for them.

They contact you and offer you the job.

You go to the interview.

You send your application.

You read an advertisement in which a company looks for a computer programmer. Your interview is successful.

We can say that the three main steps in the application process are:

1 Advertisement

2 Application

3 Interview

Let's look at them in detail.

First step: The advertisement

Job advertisements can be found on the Intern et, on special sites or on company sites, but also in newspapers and magazines.

2.Read these two advertisements and answer the questions.

|

|

|

1. Which job is better for a student? 2. Which job is full-time only? 3. Which job is not permanent? When are you required to work? 4. Which job does not require a school diploma? 5. How can you apply for both of them?

Second step: The application

After reading a job advertisement, if you are interested in the job, you send your application, usually by email. Your application must include a CV (Curriculum Vitae). This a document with information about you and your work history. A CV must be clear and easy to read, so it must be organized into sections.

3. Look at this information from a CV and put it in the appropriate sections.

- Excellent English both written and spoken

- Email: c.parker@topmail.com

- 2008-2010: accountant at French Foods, 11 Avenue St Antoine, Nantes

- M. Gaston Artois, Director General at French Foods

- 2007: High school diploma in accountancy from Lycee Saint-Louis, Tours

|

Section |

Information |

|

Personal information |

|

|

Work experience |

|

|

Education |

|

|

Skills |

|

|

References |

|

4. Two people have decided to apply for the post of bank cashier from the first advertisement on this page. Read these two applications and match the descriptions in the box to the paragraphs.

|

attachments education |

references |

skills |

|

|

work experienc opening (source of information + type of job)

|

closing hope for interview |

salutation greeting)

|

(opening |

|

Dear Staff Manager,

I am writing to apply for the post of bank cashier advertised on your site.

As you can see from my CV, I got a high school diploma in 2009. Since then I have been working as a bank cashier for a major bank here in Boston where I deal with customers' accounts and sell financial products.

I hope you will contact me for an interview.

Best regards, Paul Ascott |

Dear Sirs, - I saw your advert on your site and I am interested in the post of bank cashier.

I hope you will appreciate both my educational qualifications - I have a degree in Economics from Boston University - and my two years ' experience in the field of banking.

My computer skills are excellent and I can speak Russian well.

I attach my CV and two references.

I look forward to meeting you for an interview. |

Regards, Mary Burton apply

5. Complete the sentences with words from the box.

apply application deal with attach look forward to interview advertisement duties skills knowledge

1. I __________ copies of my diplomas.

2. I have good _________ of French and Italian.

3. My _________ include organising meetings and events and advertising.

4. I would like to ____________ for the post of computer programmer.

5. I saw your ______________ in The Daily Telegraph and I am applying for the post of secretary.

6. I _________ your reply.

7. I am available for an ____________ at any time.

8. In my present job, I ___________ accounts.

9. Excellent computer ___________ are required.

10. Please send your ___________ to this e-mail

6. These are the CVs that Paul Ascott and Mary Burton have attached to their applications.

Read them and tick the table appropriately.

|

1 PERSONAL DETAILS NAME: Paul Ascott DATE OF BIRTH: 311111991 ADDRESS: 15 Park Avenue, Boston PHONE NO. 359 9921 77 EMAIL: paul.ascott@gmail.Com

|

2 PERSONAL INFORMATION Ms Mary Burton Born in Boston on 15th June 1986 Married 35 San Diego Rd - Boston (617) 466 2481 mburton@hotmail.com |

|

EDUCATION 2004-2009 High School Diploma, High School West, Boston

PROFESSIONAL EXPERIENCE 2009 - present Atlantic Bank, 163 High Street, Boston - bank cashier Duties: dealing with customers' accounts, selling financial products

SKILLS good knowledge of standard office software |

EDUCATION High School: 2000 - 2005 Parker High School, Boston University: 2005 - 2009 Degree in Economics, Boston University

EMPLOYMENT 2009 - 2011 investment consultant at DT Bank - I assist customers in investments

SKILLS Languages: Good Russian both written and spoken Computer: Certificate in Microsoft Office

REFERENCES George Brown Teacher of Economics Boston University (617) 455 6002 gbrown@bu.com

Gordon O'Neal Manager DT Bank State Street (617) 430 8832 gordononeal@dtbank.com |

|

Who: |

Paul Ascott |

Mary Burton |

|

has a degree? |

|

|

|

is still working? |

|

|

|

does not provide any references? |

|

|

|

can speak a foreign language? |

|

|

|

is married? |

|

|

|

has experience as a bank cashier? |

|

|

|

can use a computer? |

|

|

|

lives in Boston? |

|

|

7. Now, you have decided to apply for the same post of bank cashier. Write your application email and CV using the information below. Use the layout and and vocabulary from the emails and CVs above to help.

- you have read the advertisement on the Internet

- you are 25, from Boston

- you have a high school diploma

- after school you worked for 3 years as a representative for a videogame company, then for 2 years as a bank clerk with administrative duties for a bank in Boston

- you have excellent computer knowledge

- you attach 1 reference

Third step: The interview

If your application is successful, the company contacts you for an interview before deciding whether to give you the job.

8. This is a list of typical questions and answers during a job interview. First match these titles to the questions. Then match questions and answers. There may be more than one answer for each question.

Skills Work experience Education Interest in the job

Questions

1. What are your qualifications? Education e, f

2. What school did you attend? __________

3. Tell me about your experience. __________

4. What work experience have you got? ____________

5. What are your duties? ____________

6. What experience have you got in this field? ____________

7. Do you speak any foreign languages? ____________

8. What are your computer skills and what programs can you use? _______ 9. Why do you want this job? _____________

10. What interests you about this job?

Answers

a. I am familiar with all the main computer programs.

b. I have a good knowledge of computers.

c. I think this job will improve my skills.

d. I want to get experience in this field.

e. I have a diploma in accountancy (and a degree in Economics).

f. I went to ITC Pascoli in Milan and got my diploma 3 years ago.

g. I worked for an import-export company called BC Ltd. from 2008 to 2010.

h. I have several years of office experience.

i. I am responsible for/My duties are entering data into the computer and preparing statistical reports.

j. Yes, I can speak English fluently.

9. Now imagine you have applied for a job as a shop assistant in a music shop in London.

Complete your interview with the missing words and phrases.

Interviewer: Good morning and welcome.

You: (1) _____________________________

I: I'd like to ask you a few questions. Let's start with education. What (2) ________ qualifications?

You: I (3) __________________

I: Fine. And (4) _______________ in this field?

You: I (5) _______________________

I: Can you tell me about your computer (6) ____________?

You: (7) __________________

I: That's great. Now, you can speak good English, but can you speak any other

(8) ______________?

You: (9) I ______________

I: I see. Now, one last question. Why (10) _______________?

You: (11) ____________________

I: OK. That's all for now. Thank you for coming. We'll contact you soon.

You: Thank you very much.

MY GLOSSARY

account interview

advertisement job application to apply knowledge

to attach to look forward to available permanent cashier reference

to deal with shift degree skill duty staff

education vacancy

Writing

A COVERING LETTER

When you apply for a job, you normally send a CV and a covering letter.

1. Complete the covering letter by choosing the correct verbs.

2. Choose your favourite job from Webquest or the unit and write a covering letter to apply for it.

Ms M Wilson JBD Bank

56 Cheapside

LONDON EC4Y 2WD

23 June 20_

Dear Ms Wilson,

I write / am writing to apply for the job of customer advisor, as advertised on your website on 13 June (reference WRF/236).

I am / I am being numerate, I have / am having good personal skills, and I am very interested in banking. I like / am liking contact with customers and I am good at communicating with people.

I am / I am being numerate, I have / am having good personal skills, and I am very interested in banking. I like / am liking contact with customers and I am good at communicating with people.

As you can see from my CV, I studied economics at school and I now study/ am now studying for a diploma in business studies. I think / am thinking this gives me a good background for the job.

I currently work / am currently working part-time in a bookshop, so I have / am having experience of dealing with customers and handling money. Every day I prepare / am preparing the cash balance when we close the shop.

Presently, during the holiday period, I also help / am also helping my uncle with his accounts on the computer.

I would be very pleased to have the opportunity to discuss this application further.

You can contact me by email at:jsmith@meganet.com. I look forward to hearing from you.

Yours sincerely,

James Smith

James Smith

Speaking

PRESENTING YOUR SKILLS TO AN EMPLOYER

In a job interview, you have to explain why you want to do a job and why you would be good at it. Work in groups of three or four.

1. Choose your favourite job from the unit. Prepare to explain to the others why you want the job. Use the Useful language below to help you think of ideas. Tell the others just the name of the job you have chosen.

2. Prepare at least six questions to ask the other members of your group about their job choices. Use the Useful topics below and different types of question. Three questions must be information / open Wh- questions and three must be yes / no questions.

3. One student presents their choice to the others, explaining why they want the job.

The others are the interview panel who ask questions to see if the person is suitable. Take turns so that everyone presents.

Useful topics

• your education

• skills

• experience (with examples)

• motivation

• understanding of the job's needs

• what you can offer to an employer

Useful language

• I would like to be a ... because I want to ...

• In this job you need to ...

• I like / enjoy / am good at

• analysing figures and data

• selling things

• working on computers

• solving problems

• working with people in a team.

• At the moment I am studying ...

• For me, the most important thing is ...

• I think this job will help me to ...

• I think a ... needs to be ...

UNIT 2 THE SCIENCE OF ECONOMICS

Read the international words and guess their meanings:

Economic activity, economic system, macroeconomics, microeconomics, to produce, to operate, to protect, to analyze, to finance, to manufacture, to specialize, to focus, to affect, service, school, hospital, garage, fact, base, production, material, industry, radio, strategy, status, export, import, institution, distribution, division, investment, history, organization, period, spectrum, agriculture, essential, basic, industrialized, oriented (policy), national, financial, social, major, fact, base, total, primarily, public.

2.1 ECONOMIC ACTIVITY

Most people work in order to earn their living. They produce goods and services.

Goods are either produced on farms, like maize and milk, or in factories, like cars and paper.

Services are provided by such things as schools, hospitals and shops. Some people provide goods, some provide services.

Other people provide both goods and services. For example, in the same garage, a man may buy a car or he may buy some service which helps him to maintain his car.

The work which people do is called their economic activity. Economic activities make up the economic system.

The economic system is the sum-total of what people do and what they want.

The work which people undertake either provides what they need or provides them with money. People buy essential commodities with money.

in order to для того, щоб

goods and services товари та послуги

to provide services надавати послуги either… or…. або … або … both… and… як …, так і … to make up складати

commodity товар

the sum-total загальна сума

1. Give Ukrainian equivalents to the following:

To earn their living, goods like maize, services are provided by …, to provide both goods and services, to maintain a car, the work which people undertake, to buy with money, essential commodities.

2. Complete these sentences with the words given below and translate them into Ukrainian: essential commodities, provide, undertake, maintain, the sum-total

1. People buy ……. with money.

2. Some people ……., some …. services.

3. The work which people … provides what they need.

4. Some service may help a man … a car.

5. The economic system is ….. of what people do and what they want.

3. Complete the sentences:

1. Most people work………..

2. Economic activities make up………

3. Economic activity is …………………

4. Economic system is……….

5. A man may buy some service which……

4. Answer some questions on the Text:

1. Why do most people work? 2. What do they produce? 3. Where are goods produced? 4. What do schools, hospitals and shops provide? 5. What two different things can a man buy in, for instance, a garage? 6. What do we call the work which people do? 7. What is an economic system the sum-total of? 8. What two things can work provide for the market? 9. What can people buy with money?

2.2 THE SCIENCE OF ECONOMICS

Economics is a science. This science is based upon the facts of our everyday lives. Economists study our everyday lives. They study the system which affects our lives. The economist tries to describe the facts of the economy in which we live. He tries to explain how the system works. His methods should be objective and scientific. We need food, clothes and shelter. If we could get food, clothes and shelter without working, we probably would not work. But even when we have these essential things, we may want other things. If we had them, these other things (like radios, books and toys

Economics is a science. This science is based upon the facts of our everyday lives. Economists study our everyday lives. They study the system which affects our lives. The economist tries to describe the facts of the economy in which we live. He tries to explain how the system works. His methods should be objective and scientific. We need food, clothes and shelter. If we could get food, clothes and shelter without working, we probably would not work. But even when we have these essential things, we may want other things. If we had them, these other things (like radios, books and toys

for children) might make life more enjoyable.

The science of economics is concerned with all our material needs and wants. It is not just concerned with basic needs like food, clothes and shelter.

to affect smth., smb. впливати на щось/когось

to describe описувати to explain пояснювати

scientific науковий

to be concerned with бути пов’язаним з, мати відношення до

чогось

1. Give Ukrainian equivalents to the following: to be based upon, to affect our lives, to describe the facts, to explain how the system works,

objective, probably, essential things, make life more enjoyable, to be concerned with, basic needs

2. Complete these sentences with the words given below in appropriate form and translate the sentences into Ukrainian: to be concerned with, to explain, to affect, enjoyable, method

1. Economists study the system which ……. our lives.

2. The economist tries ……… how the system work.

3. Economic …… should be objective and scientific.

4. Radios, books and toys for children make life more ….

5. It …. essential things.

3. Complete the sentences and translate them into Ukrainian:

The science of economics ……

Economists try …… Even when we have … We need ….

Economics is based upon … If we could get food ….

4. Answer some questions on the Text:

1. What is economics? 2. What is it based upon? 3. What two things do economists study? 4. What does the economist try to describe? 5. What should the economist’s methods be? 6. What do we need? 7. What things might make life more enjoyable? 8. What is the science of economics concerned with?

2.3 ECONOMIC STRATEGIES

Four Asian nations – Hong-Kong, Singapore, South Korea and Taiwan – are now called NICs, newly industrialized countries. Their new status is a product of outward-oriented development strategies.

In the 1950s and 1960s, the governments of the four countries protected domestic markets from foreign competition to stimulate domestic production for domestic consumption.

Taiwan was the first to replace an inward-oriented policy with an outward-oriented policy. The other three countries followed closely behind. Soon each country experienced rapid growth in exports and domestic national income.

These countries maintain some restrictions on the domestic economy, but operate with another set of rules for exporting firms. Production for export occurs in a free market setting, with no taxes or restrictions on imports of the materials needed to manufacture goods for export.

The governments have developed banking and financial institutions that can finance export production and sales.

Notes:

setting – умова

1. Answer some questions on the Text

1. What are four Asian countries called? 2. What is their new status? 3. What did the governments of these four countries protect in the 1950s and 1960s? 4. What did they want to stimulate? 5. What was Taiwan the first to replace? 6. What was the result of this new policy? 7. Do these countries maintain some restrictions on the domestic economy? 8. How does production for export occur in a free market setting in these countries? 9. What have the governments developed?

2. Render the contents of the Text in Ukrainian.

3. Read and translate the Text.

ECONOMICS

Economics is a social science that seeks to analyze and describe the production, distribution, and consumption of wealth. The major divisions of economics include microeconomics, which deals with the behaviour of individual consumers, companies, traders, and farmers; and macroeconomics, which focuses on aggregates such as the level of income in an economy, the volume of total employment, and the flow of investment. Another branch, development economics, investigates the history and changes of economic activity and organization over a period of time, as well as their relation to other activities and institutions. Within these three major divisions there are specialized areas of study that attempt to answer questions on a broad spectrum of human economic activity, including public finance, money supply and banking, international trade, labour, industrial organization, and agriculture. The areas of investigation in economics overlap with other social sciences, particularly political science, but economics is primarily concerned with relations between buyer and seller.

2.4 ECONOMIC INDICATORS

1. What facts do you know about the economy in your country? Work in pairs and make notes of

your answers.

1 How many people live in your country?

2 What is happening to prices in the shops?

3 How many people have no job?

4 What is the exchange rate of your country's currency to the US dollar?

5 Is your country's economy growing or declining?

6 How much interest do you pay on bank loans?

Report back your answers to the class.

2. When we talk about these facts, we are talking about 'economic indicators'. The pictures below

represent key economic indicators. How many of them can you name?

Reading

INTERPRETING DATA

1. What can you learn about an economy from its economic indicators? Look at the table for these two developing economies: Turkey and Poland. Match the indicators a-h with the definitions 1-8.

|

1. the movement of prices in the economy |

_f_ |

|

2. the cost of borrowing money from a bank |

___ |

|

3. the relation between imports and exports |

___ |

|

4. the value of a country's money compared with other currencies, such as the US dollar |

___ |

|

5. the number of people who live in a country |

___ |

|

6. the number of people with no job |

___ |

|

7. the total size of an economy |

___ |

|

8. the rate of expansion in the economy |

___ |

|

Economic indicators |

Turkey |

Poland |

|

a Population |

76.8m |

|

|

b Gross domestic product |

|

US$ 686.2bn |

|

c Growth rate |

-5.8% |

|

|

d Interest rates |

|

5.0% |

|

e Unemployment rate |

14.6% |

|

|

f Inflation |

|

3.4% |

|

g Exchange rate |

US$ 1 = YTL * 1 .55 * Turkish New Lira |

|

|

h Balance of trade |

|

US$ -3.585 |

2. Student A, go to the next page. Student B, look at the table above. Work together and find the missing statistics in your table.

Take turns to ask for and give the missing figures. Then read back the statistics you have written to your partner and check if they are right.

Student A

Take turns to ask for and give the missing figures. Then read back the statistics you have written to your partner and check if they are right.

|

Economic indicators |

Turkey |

Poland |

|

a Population |

|

38.4m |

|

b Gross domestic product |

US$861.6bn |

|

|

c Growth rate |

|

1.1% |

|

d Interest rates |

25% |

|

|

e Unemployment rate |

|

11.0% |

|

f Inflation |

5.9% |

|

|

g Exchange rate |

|

US$ 1 = PLN 3.1 • Polish zlotych |

|

h Balance of trade |

US$ -12.54bn |

|

3. What can you learn from this data about the two countries? Discuss in pairs or small

groups.

1 Which country has the bigger economy?

2 Which country has the higher growth rate?

3 Which has the worse inflation rate?

4 Which has the better interest rates for borrowers?

5 Do you see any dangers for the economy in any of the indicators?

Vocabulary

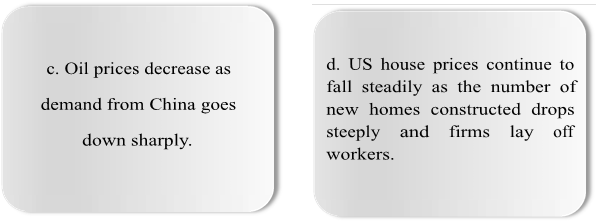

a. German unemployment rate falls slightly as the b. Bank of England warn as economy continues to create inflation increases sharply to new jobs. Exports, especially 3.4%. House owners suffer more of machinery, rise pain as mortgage rates go up by dramatically as world 0,5% from 4,5% to 5%. demand remains strong.

a. German unemployment rate falls slightly as the b. Bank of England warn as economy continues to create inflation increases sharply to new jobs. Exports, especially 3.4%. House owners suffer more of machinery, rise pain as mortgage rates go up by dramatically as world 0,5% from 4,5% to 5%. demand remains strong.

DESCRIBING TRENDS 1

1. Look at the news stories. Underline the verbs that tell you how the indicators moved: up or down. Mark them with an arrow showing the direction up (↑) or down (↓).

2. Now complete the table with the verbs you underlined.

|

to increase |

to decrease |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3. When we describe a change, we can be more precise by putting an adverb after the verb. Find these adverbs in the headlines: slightly, steadily, sharply, steeply, dramatically. Which of the adverbs describe

• a big change?

• a small change?

• a continuous change over time?

4. Read the text and underline the verbs and phrases that describe key trends. There are eight verbs and phrases in all.

Over the last

Over the last

month

oil prices have fluctuated wildly between $95 and $123. Prices rocketed at the beginning of the month and they reached a new peak

of $123 But, with fears of an economic slowdown, the price subsequently plunged and hit a low of $95 last Thursday. They levelled off at the beginning of this week at $108 and have now recovered to $115.

But oil analysts expect they will surge to new highs over the next 2 months.

Reading

LIFE IN MODERN BRITAIN

1. Economic indicators can give us a picture of the historical development of a country. Think back to the life of your parents' generation. What do you think people spent their money on 50 years ago?

Now read the text and find out about life in the UK 50 years ago.

What can economic indicators tell us about life in modern Britain?

In 1957, the UK government began a survey of the spending of a typical English family called the Family Spending Survey.

In this year, three items made up nearly 50% of all family expenditure: food, fuel, and rent. If you include clothing and travel, these basics made up nearly 70%

of all family spending. The main luxuries for the ordinary family were tobacco and alcohol, which represented just under 10% of spending. The next biggest luxury item was meals eaten out in restaurants, representing 3% of spending.

When the government did the same survey fifty years later in 2007, the figures were very

different.

2. Discuss in pairs. What do you think are the largest items of family spending today?

3. Put these items in order of importance (1 = biggest item; 5 = smallest item):

food ___________ clothing __________ housing __________ leisure ___________ transport _________

4. Now read the conclusions of the 2007 report and write the correct percentage against each

item. Were you right?

Over the last fifty years, UK family income has doubled in real terms, but the pattern of family spending has changed dramatically. Basic necessities, including food, now account for only 15% of our family budget, compared with 33% in 1957.

And half of that food budget now consists of meals and takeaways - a new category introduced in the 1970s.

But the cost of housing, including mortgage interest payments or rent, has more than doubled since 1957 from 9% to 19%.

However, the biggest change is in the growth of leisure, including everything from holidays, DVD rentals and sports clubs. This now represents 7% of spending, while clothing is only 5%.

Motoring and travel costs have increased sharply from 8% of spending in 1957 to 16% in 2006, mostly because of rising car ownership, with three in four families owning at least one car.

Surprisingly, spending on alcoholic drinks accounts for the same proportion of spending as it did 50 years ago at 3% - although in absolute terms it is much higher.

But, in contrast, the proportion of the average budget spent on tobacco has fallen sharply from 6% in 1957 to just 1 % in 2006.

5. Discuss in pairs.

1 Why do you think spending on food has fallen so sharply?

2 Why has transport spending increased so dramatically?

3 Family income has doubled over fifty years, but does higher income create happiness? What kind of problems could it bring?

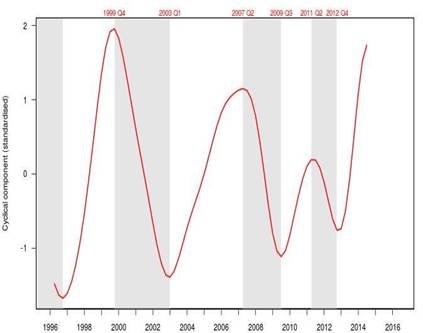

2.5 ECONOMIC CYCLES

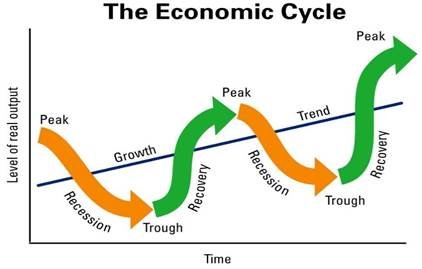

1. Look at the graph showing the typical cycles of an economy.

1 How long does a normal economic cycle last? Circle the correct answer.

a. about three months c about five years

b. about a year d about ten years

2 Why do economies move in cycles?

2. How does your spending in the shops affect this cycle?

2. How does your spending in the shops affect this cycle?

Complete the sentences.

When people reduce their spending, the economy experiences a r________.

2 When they increase their spending, the economy experiences a r______.

3. Look at the words below which are commonly used to describe economic cycles.

3. Look at the words below which are commonly used to describe economic cycles.

1 Which words describe positive growth and which are negative?

Mark them + or -.

2 Which words describe a shortterm phase (three months) and which are medium-term (six months and more)? Mark them S/M or both.

3 Which words describe extreme conditions of the cycle? Mark them !.

|

|

+/- |

S/M |

! |

|

a slump |

|

|

|

|

b upturn |

|

|

|

|

c recession |

|

|

|

|

d boom |

|

|

|

|

e downturn |

|

|

|

|

f recovery |

|

|

|

RECESSION AND RECOVERY

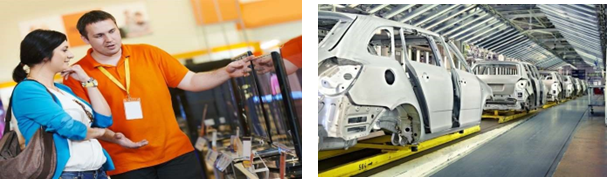

1. Look at the pictures. Say which photos show

1 a recovery 2 a recession.

2. Work in pairs. Look at the sentences below. Decide which of these things usually happen a in a recovery b in a recession.

|

1 People lose their jobs. |

□ |

|

2 Companies create jobs. |

□ |

|

3 Companies produce fewer goods. |

□ |

|

4 Companies invest to increase production. |

□ |

|

5 Interest rates begin to fall. |

□ |

|

6 Governments start to increase interest rates. |

□ |

|

7 Prices begin to rise and inflation increases. |

□ |

|

8 Prices fall and profits decrease. |

□ |

|

9 Many companies go bankrupt |

□ |

|

10 People often start up new businesses. |

□ |

Reading

MANAGING THE WORLD ECONOMY

1. Read the article and answer the questions.

1 Why were the IMF and the World Bank founded?

2 What is the difference between them?

3 Which of them could help with a big infrastructure project like a hospital or school?

4 Which of them could help a country if it has a crisis with its foreign exchange rate?

5 Why are they now being criticized?

The IMF and the World Bank

The IMF and the World Bank were set up at the Bretton Woods conference in the USA in 1944. The 45 governments at the conference decided to build a system of economic cooperation among countries to avoid the mistakes that caused the Great Depression of the 1930s.

The IMF is based in Washington, DC, USA and is governed by the 185 countries that are members. However, the IMF is not a bank. Its job is to maintain stability in the world economy and help countries which are experiencing financial difficulties, perhaps with repaying debt on loans or when the value of their currency has collapsed. But the IMF cannot tell a government what to do: it can only advise.

The World Bank has the different task of lending money to developing countries to help longterm construction and to support social programmes to reduce poverty or disease. Many of its programmes in developing countries support big long-term infrastructure projects like dams, water systems or road systems which governments do not have the money to build.

Charged with failure

Both institutions face a lot of criticism today. The Fund is often criticized for ignoring local conditions of poverty in developing countries and imposing single 'western' solutions onto weak economies. By advising governments, for example, to cut government spending in order to reduce inflation, they can create unemployment in poor countries. The Bank is being criticized for concentrating too much on big infrastructure projects like dams and motorways. Critics say these projects ignore the real needs of poor people to grow food, get water or set up small businesses. Environmental protesters also say that big projects can destroy local environments for farmers by changing ecosystem.

Both institutions reject such criticism, and they are making big efforts to reform by talking more with local people and focusing more on small micro projects using local experience.

Both institutions believe that one of the most important reforms is to have new emphasis on consulting with national governments, local experts, and aid organizations before developing any policies.

2.6 ECONOMIC SECTORS

1. Where do most people in your country work? Is it in agriculture, in industry, or in services?

2. A modern economy is made up of three different sectors: the primary sector, the secondary sector, and the service sector. Match the sectors with their definitions.

1 The ________ manufactures finished products.

2 The_______ provides the raw materials and natural resources for industry.

3 The ________ provides support activities for customers or other industries.

3. Answer the questions.

Which sector do you think is the biggest in a developed economy like the USA? Which sectors are biggest in your country? Which are growing and which are declining?

4. Which sector do these international companies belong to: Nike, McDonalds, Ford, Google, Nestle, Hilton Hotels?

Vocabulary

INDUSTRIES AND SECTORS

1. The photographs below show different industries.

How many of them can you name? Complete the captions. Then write which sector they belong to.

(The first one has been done for you.) Use a dictionary to check your answers.

2. Now compare your answers with a partner and fill in any gaps.

3. How many of these industries do you have in your country?

s t e e l production t _ _ _ _ _ _ _ _ and logistic Sector: Secondary Sector: _____________

s t e e l production t _ _ _ _ _ _ _ _ and logistic Sector: Secondary Sector: _____________

a _ _ _ _ _ _ _ _ _ _ textiles and c _ _ _ _ _ _ _

Sector: _____________ Sector: _____________

f _ _ _ processing m _ _ _ _ _

f _ _ _ processing m _ _ _ _ _

Sector: _____________ Sector: _____________

a _ _ _ _ _ _ _ _ _ _ o _ _ exploration

a _ _ _ _ _ _ _ _ _ _ o _ _ exploration

Sector: _____________ Sector: _____________

r _ _ _ _ _ _ _ _ c _ _ manufacturing

r _ _ _ _ _ _ _ _ c _ _ manufacturing

Sector: _____________ Sector: _____________

4. Look at the report below from an investment bank on the structure of the Turkish economy.

Complete the report with words from 1.

![]()

The Turkish economy: background

![]()

In Turkey, the primary sector is made up of _____ 1 which produces basic foods, like fruits, vegetables, and wheat, and the exploration industries like ________ ________ 2 which provide our basic energy and gas, or _____ 3 which extracts minerals and material for building.

The secondary sector consists of manufacturing industries, like the ________

4 industry. Also there are the processing industries, for example _______ ______

5.

The manufacturing sector is divided into heavy industries which need great power and big investment in machinery, for example ______6, and light assembly industries, like ________ 7, which produce goods for the fashion industry and need little investment.

The service sector includes many different activities which support both businesses and private customers. Businesses need services like _____ 8 to move or store goods and other marketing services, like ______9 to tell customers about their products.

But the biggest part of the private service sector is made up of consumer services, like the _____ 10 sector, which contains shops where we buy things, the finance sector, including banks and insurance, and the fast-growing tourism sector for the international travel market.

![]()

5. Work in pairs. Discuss how the Turkish economy compares with the economy in your

country.

Reading

COMPETING IN THE GLOBAL ECONOMY

Most business strategists now believe that a country, like a company, must build on its key strengths – the sectors and industries which give it a competitive advantage over other countries, such as low labour costs, technology, and natural resources.

1. Before you read, discuss what you think are the key strengths of an emerging economy like China.Work in pairs.

You are going to compare the key strengths of an emerging economy, China, and a developed economy, the UK. Student A, go to p. 32. Student B, read the report on the UK economy and make notes on the strengths and weaknesses of each sector. In order to do this, you will need to:

1 find the examples given for each sector

2 find the strengths mentioned

3 find the weaknesses mentioned

4 add the information in note form.

![]()

THE UK ECONOMY

![]()

In the UK, the primary sector is made up of farming, and energy-related activities. Farming is very mechanized and uses a lot of machinery, producing about 60% of food needs although it employs only 1 % of the workforce. But many small farms are n0 longer profitable on global markets with low-cost world producers. Primary energy accounts for about 10% of GD, one of the highest figures for a developed economy. The UK also has important reserves of oil, gas, and coal. However, this sector is now declining and oil and gas production will fall sharply in the next ten years, making the economy dependent on foreign imports of energy.

The secondary sector has continued to suffer from the decline of old heavy industries, like steel, and the closing of mass manufacturing like the car industry. This has created big job losses especially in the north. In the last few years, these old industries have been replaced by new specialist engineering companies with high added-value products and niche markets. However, despite government support, the sector has decreased from 20% to 15% of GDP over the past twenty years.

By contrast, the service sector is booming, benefiting from its highly qualified workforce and the concentration of expertise in the south east. It now represents over 70% of the total economy with financial services, computing and marketing contributing 30% to GDP. But the success is very dependent on financial markets, and the recent growth has put great pressure on road and rail infrastructure in the south east. All this means that future growth will be limited in the short to medium-term.

![]()

⃰ There is an example of how to do this in the first paragraph of the table. When you have looked at this, read the rest of the report and complete the table in the same way.

|

UK |

Examples |

Strengths |

Weaknesses |

|

Primary sector |

• Farming |

Mechanized Produces 60% of food needs |

Employs only 1% of workforce Not profitable on global markets |

|

• Energy-related activities |

Accounts for 10% of GDP High reserves of oil, gas, and coal |

Sector declining Production will fall in next 10 years |

|

|

Secondary sector |

• _________ a

|

|

Decline of _______f industries |

|

• _________ b

|

|

Closure of _______g Big ________h losses

|

|

|

• _________ c

|

• Higher _______d products • _________e markets

|

|

|

|

Service sector |

• _________ i

|

_________l workforce

concentration of _______ m |

Dependent on _________n

Infrastructure problems, e.g. ________o |

|

• _________ j |

|||

|

• _________ k |

Student A

![]()

THE CHINESE ECONOMY

![]()

![]()

In the primary sector of the Chinese economy, agriculture has benefited from the move to private and village farms, creating new specializations, especially in the coastal regions near Hong Kong. Farming is very intensive, more productive per acre than the US, and produces significant exports of rice, wheat and meat. However, productivity is achieved by human labour and small farms lack machinery and capital for investment and often suffer from the effects of pollution and problems of water.

In the secondary sector, the opening of the country to foreign investment and technology has played a big part in modernizing Chinese industries. China is now a leader in electronics, textiles, and consumer products. Manufacturers still enjoy the benefit of a huge low cost workforce and relatively cheap land. However, a lot of the country's capital is invested in old state sector industries, often with great waste and inefficiency. The whole sector suffers from poor infrastructure, bureaucracy, and shortages of electric power and raw materials.

The service sector in China includes marketing, software, and customer services but it is still underdeveloped and businesses lack finance and technical knowledge. However, with the rise in living standards and a huge boom in Internet use, demand for services has increased dramatically. Private companies have used their own capital to develop, giving these companies great flexibility and independence from government control.

![]()

|

CHINA |

Examples |

Strengths |

Weaknesses |

|

Primary sector |

• Agriculture |

New specializations following move to private/ village farms

Farming more intensive and more productive than US |

Human labour used

Lack of machinery and investment capital

Pollution and water problems |

|

Secondary sector |

• _________ a • _________ b • _________ c

|

Benefits from: • _______d • ______ e |

Too much capital invested in ________f Problems: • _________g • _________h Shortages of: • _________i •_________j

|

|

Service sector |

• _________ k • _________ l • _________ m |

Demand for services_____n because of: • ________o • ________ p Private companies use____q giving them: •_________r •_________s

|

Businesses lack: • ________t •________u |

2. Now Student B is to complete the table below on the Chinese economy, by asking Student A questions.

EXAMPLES

What are the key industries in the Chinese primary sector? What are the weaknesses of the Chinese service sector?

|

CHINA |

Examples |

Strengths |

Weaknesses |

|

Primary sector |

• Agriculture |

New specializations following move to private/ village farms

Farming more intensive and more productive than US Significant food exports of _____a, _____b, and _____c |

Human labour used

Lack of _____d and investment capital

Pollution and ______e problems |

|

Secondary sector |

• Electronics • _________ f • _________ g

|

Modernization caused by _______h Low-cost workforce Cheap _________i |

Still investing in old ________j Poor _________k Bureaucracy Shortages of ________l and _________m |

|

Service sector |

• Marketing • _________ n • _________ o |

Demand for services dramatically increased because of: • ________p • ________ q Private companies use ___r for investment, making them more flexible and independent

|

Businesses lack ________s and ________t knowledge |

Writing

REPORTS: COMPARING OPTIONS

The plant location decision has now been passed to the investment board for a decision. As the assistant to the chairperson you have been asked to prepare a report comparing the two options: the UK or China.

When we make a direct comparison between two ideas or statements, we can use several linking words, including while and whereas.

In China, we will have problems with finding experienced business managers while/whereas in the UK we can use our existing management.

We can also use by contrast when the comparison is expressed in a new sentence.

In China, few workers have high levels of education. By contrast, in the UK, we can recruit graduates easily.

Look back at the notes you made in Listening and complete the report.

UNIT 3 ECONOMIC SYSTEMS

Read the international words and guess their meanings:

To characterize, to determine, indifferently, differently, traditional, private, resources, to maximize, centralize, to act, manner, productive, planned economics, theory, epoch, culture, to contribute, technique, cultivation, Roman empire, bourgeois revolutions, socio-economic formations, primitive-communal system, period, nature, instruments, to separate, to lead (led), to control, to regulate, to expand, dominant, universal, prevailing form of production.

3.1 ECONOMIC SYSTEMS

Different economic systems answer the “what”, “how” and “for whom” questions differently. The main economic systems today are capitalism, socialism, communism, mixed economies and traditional economies.

Capitalism - is an economic system characterized by private ownership of most resources, goods and services. Capitalism relies on the market system to allocate resources, goods and services to their most highly used value. In capitalist economy what to produce is determined by consumers, how to produce is determined by profit-seeking entrepreneurs, who maximize profit by producing in the most sufficient manner, and for whom to produce is determined by income and prices. In a capitalist system workers are generally paid according to how productive they are, and the distribution of income is unequal because people differ in their abilities.

Socialism - is an economic system characterized by government ownership of resources other than labour and centralized economic decision making. Under socialist system government authorities answer the “what”, “how” and “for whom” questions. In a socialist system government planners set wages and though wages are not equal for all workers, incomes tend to be more evenly distributed than in capitalist countries.

In centrally planned economies government planners decide what goods will be produced and set the prices at which they are sold.

Communism - is an economic system in which all resources (including labour) are commonly owned and economic decisions making is centrally planned. According to communist theory, people contribute what they are able to the economy but receive what they need. In theory, this means that goods are produced for use rather than to earn profits and that everyone’s needs are met. Communist countries have central planning boards that set prices.

|

private ownership to rely on to allocate value profit income an entrepreneur sufficient according to equal (ant. unequal) decision-making wage rather than |

приватна власність покладатися на розподіляти, розміщувати цінність, вартість прибуток дохід підприємець суттєвий згідно з рівний приймання рішень заробітна платня скоріше … ніж |

1. Give English equivalents to the following: покладатися на, збільшувати прибуток, визначатися кимось, розподіл доходів, відповідно до, здібність, за часів соціалістичної системи, урядова влада, встановлювати заробітну платню, робити внесок, ради (департаменти) з планування.

2. Complete these sentences with the words given below in appropriate form and translate the sentences into Ukrainian:

government authority, a government planner, the distribution of income, to determine

1. Capitalism relies on ……...

2. In capitalist system how to produce – is …….. by profit-seeking entrepreneurs.

3. In capitalist system …… is unequal because people differ in their abilities. 4. Under socialist system ….. answer the “what”, “how” and “for whom” questions.

4. In centrally planned economies ….. decide what goods will be produced.

3. Complete the sentences and translate them into Ukrainian:

1. The main economic system today are….

2. Entrepreneurs maximize profit by…

3. In a capitalist system workers are paid according to…

4. Different economic systems answer…

5. Capitalism is characterized by … 6. According to communist theory …

4. Answer some questions on the Text:

1. What are the main economic systems today? 2. What economic system does private ownership of most resources, goods and services characterize? 3. Who determines what to produce in a capitalist economy? in a socialist economy? 4. Why is distribution of income unequal in a capitalist economy? What is it like in a socialist economy? 5. What economic system does government ownership of resources characterize? Does the government own labour in such systems? 6. How can you characterize centrally planned economies? What are their specific features? 7. What is the difference between socialist and communist economies?

3.2 FIRST SOCIO-ECONOMIC FORMATIONS

The first socio-economic formation was the primitive-communal system, which covered the period of many hundred years. At first people were in a semi-savage state, powerless against nature. They gathered nuts, wild fruit and berries, roots and plants. Man’s first instruments were roughly chipped stones and sticks. Later people learnt to make the simplest tools.

The basis of production relations was communal ownership of the primitive labour instruments and production means. People lived together in communes. With the advance of cattle-breeding and agriculture there arose a social division of labour: animal husbandry (скотарство) separated from agriculture.

This led to higher productivity and productive forces growing.

Productive forces continued to expand and man began to produce more. It became possible to use workmen obtained through warfare (в війнах). Captured prisoners became slaves. There followed the first division of society into classes known as slavery. Slave-owners possessed both the means of production and the people engaged in production. The ancient world achieved considerable progress in economy and culture. But time passed, and the necessity to replace the slave-owning relations arose: the new feudal mode of production began to take shape.

semi-savage напівдикий, первісний to be engaged in smth займатися чимось slavery рабство

advance успіх, прогрес, поліпшення means of production засоби виробництва

tools інструменти

roughly грубо

1. Give English equivalents to the following:

Значний прогрес, засоби виробництва, основа виробничих відносин, соціальний поділ праці, відділитися від, стало можливим використовувати, захоплений полонений, рабовласник, стародавній світ.

2. Complete these sentences with the words given below in appropriate form and translate the sentences into Ukrainian: to cover, to possess, to gather, to achieve, to learn, to separate

1. The ancient world … considerable progress in economy and culture.

2. Slave-owners …. both the means of production and the people engaged in production.

3. The primitive-communal system …. the period of many hundred years.

4. People … nuts, wild fruit and berries.

5. Then people … to make the simplest tools.

6. Animal husbandry … from agriculture.

3. Complete the sentences and translate them into Ukrainian:

1. The basis of production relations was ….

2. Man’s first instruments were ….

3. Social division of labour led to …

4. Captured prisoners were…

5. At first people were…

6. People lived together in …..

4. Answer some questions on the Text:

1. What was the first socio-economic formation? 2. What period did it cover? 3. What did people live on in a primitive society? 4. What was the first major social division of labour in history? 5. What did the first division of society into classes mean? 6. What were the relations in production based on?

3.3 FEUDALISM AND CAPITALISM

The feudal system existed in almost all countries. The epoch of feudalism covers a long period. In China the feudal system existed for more than two thousand years. In the West-European countries feudalism spread over some centuries, from the fall of the Roman empire to the bourgeois revolutions in England and France. In Russia it lasted from the 9th century to the abolition of serfdom in 1861.

The production relations of feudal society were based on the private landed property of the lords and their incomplete property rights over the serf. He was not a slave, he had his own holding (господарство). The peasant holding was the means by which the landlord secured his labour force.

![]() The towns inhabited mainly by craftsmen and traders, were subjected to the authority of the feudal lord on whose land the town was built.

The towns inhabited mainly by craftsmen and traders, were subjected to the authority of the feudal lord on whose land the town was built.

Under feudalism the productive forces reached a higher level than those under the slave system. Production technique in agriculture was improved, new branches of field cultivation arose, market-gardening developed

considerably.

But the feudal system acted as a brake on the productive forces development, so capitalist relations of production began to appear. The abolition of feudalism became a historical necessity.

The development of capitalism dealt a crushing blow (завдали нищівного удару) to natural economy. Under capitalism everything, including man’s labour power, took the form of a commodity. Commodity production became dominant and universal.